Strategic report

Industry Overview, Strategy, Risks and KPIs

Market (Industry) Overview

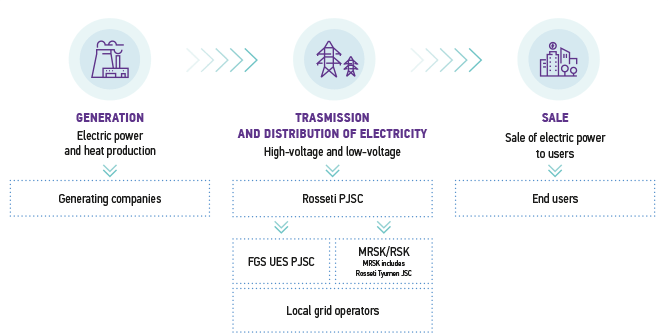

The modern power complex of Russia has a three-component structure: power generation, transmission, and sale (see fig.).

Rosseti PJSC is involved in power transmission and distribution. Being the country’s largest grid company, Rosseti PJSC combines a main-line grid complex, interregional distribution grid companies (including Rosseti Tyumen JSC), and regional distribution grid companies.

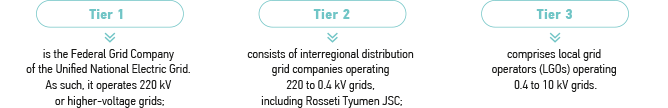

Russia’s energy industry is divided into three tiers based on technological, administrative, and territorial attributes:

Macroeconomic Trends of the reporting year, industry (market) forecast

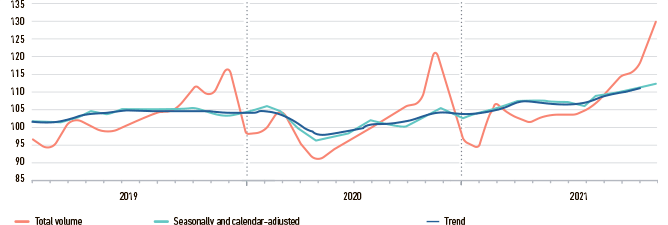

Russia’s GDP growth in 2021 was the highest since 2008 and amounted to 4.7%, although the inflation rate was also the highest since 2015, amounting to 8.39%.

According to the Federal State Statistics Service of the Russian Federation, in 2020 the Russian economy declined by 2.7%, in 2019 the growth rate of economy amounted to 2.2%, in 2018 – to 2.8%, in 2017 – to 1.8%, in 2016 – to 0.2%.

Thus, as compared with the “pre-Covid” year 2019, growth of Russian GDP in 2021 amounted to 1.9%.

The growth dynamics of the GDP and its components in 2021 against 2020 is due to the economic recovery.

According to Rosstat, production increased in almost all sectors of the economy in 2021. As compared to 2020, the “electricity, gas and steam supply” segment demonstrated a significant increase in added value in comparison with other industries (6.1%).

The share of net exports (exports minus imports) in the Russian economy grew up to 9.6% in 2021 from 5.2% in 2020.

According to Rosstat, the Industrial Production Index in 2021 as compared to 2020 was 105.3% in December 2021 against 106.1% in the relevant period of the previous year, which reflects the rapid recovery of large industrial companies.

One of the few negative macroeconomic factors in 2021 was record-breaking inflation rate which amounted to 8.39%, the maximum rate since 2015. Significant inflationary pressure was largely driven by global trends – in 2021, an unprecedented rise in commodity and consumer prices around the world was observed, with supply chains being disrupted and extended.

According to the Bank of Russia’s forecast, the GDP is expected to decline by 8.0% in 2022 instead of the previously forecasted growth by 2.4%. The forecast is reduced by 1.1 p.p. to 1.0% for 2023, and by 0.5 p.p. to 1.5% for 2024. Projected long-term GDP growth rates reduced by 1.0 p.p. to 1.0%.

Inflation projections raised by 14.5 p.p. up to 20.0% for 2022 , by 4.0 p.p. up to 8.0% for 2023, and by 0.8 p.p. up to 4.8% for 2024.

The dynamics of oil and gas exports is expected to be uneven over the forecast horizon. In 2022, the index is projected to grow by 7.4% at face value and by 9.0% in real terms due to the increase in the volume of oil exports under the OPEC+1 deal.

Taking into account the existing OPEC+ deal, the base case projects an increase in oil production to 557.6 million tons by 2024. In the conditions of the development of crude oil refining, the gradual modernization of oil refineries and an increase in the depth of oil refining, oil exports will amount to 269.0 million tons by 2024. The growth of oil exports to non-CIS countries is projected to amount to 250.97 million tons by 2024, mainly due to an increased supply to Asia-Pacific countries. Exports to the CIS countries will remain at 18.05 million tons in 2021-20242.

In the medium term, the country’s total gas production will continue to increase. The projected growth in gas production (up to 799.6 billion cubic meters in 2024) will be provided by development of 33 PJSC Gazprom’s fields, as well as by increased production by independent gas producers.

The increase in the regulated tariffs of grid companies for consumers other than individuals will amount to 3.8% on average in the country in 2022. Given the growth in consumption, such increase should compensate grid companies for significant cost inflation caused by rising material and equipment costs. In 2023–2024, indexation parameters will be in line with previously adopted long-term parameters that originate systemic pressure on the increase in costs of grid companies The annual increase in the regulated tariffs for consumers other than individuals will remain under 3.0% in the specified period3.

The Company’s major customers that account for the bulk of stable energy consumption in the Tyumen Region are oil and gas companies that produce 64% of Russia’s oil and 91% of its gas. These companies consume 84% of the Company’s net output. The key factors that affect the Company’s net output are as follows:

- oil production rate in Russia;

- demand for petroleum products in Russia and globally;

- own power generation of oil and gas companies;

- new capacities under the grid connection agreements;

- temperature factor.

OPEC agreement, adopted at the meeting of the OPEC+ countries on July 18, 2021 regulates oil production rates which has resulted in growing oil production in the Russian Federation increasing monthly since August 2021 by 100 thousand barrels per day, which, subsequently, resulted in an increase in electricity consumption by major oil and gas companies, their consumption share equaling 84% in the Company’s total volume.

The net electricity output in 2021 amounted to 43,458 million kWh which is 2,255 million kWh or 5.7% higher than in 2020.

The growing sanctions impact on the Russian economy, as well as the cessation of oil and gas delivery to the United States and the EU countries, may lead to a 14.1% decrease of energy consumption in the oil and gas sector of the Tyumen region in 2022.

In order to stabilize the Company’s financial and economic status in the long term, Rosseti Tyumen JSC implements proactive and constant measures to stabilize financial and economic performance in terms of costs optimization, maintaining an effective tariff policy, getting income from other sources.

Market Position of the Company

Rosseti Tyumen JSC is the largest territorial grid company in the Tyumen region, KhMAO and YNAO. It leads in the market of electric power transmission services to end consumers among the distribution grid companies of the Tyumen energy system, located on the territory of three Russia’s constituent entities: Yamalo-Nenets Autonomous Okrug, Khanty-Mansi Autonomous Okrug –Yugra and the Tyumen Region, with 67.5% market share.

Rosseti Tyumen JSC comprises nine branches in three of Russia’s constituent entities, namely:

- YNAO: Northern and Noyabrsk Electric Grids;

- KhMAO-Yugra: Kogalym, Nizhnevartovsk, Surgut, Nefteyugansk, and Uray Electric Grids, as well as Energocomplex;

- The Tyumen Region: Tyumen Electric Grids, including three sub-branches: Tobolsk, Ishim, and Yuzhnoye LGUs.

Rosseti Tyumen JSC contributes to the growing industrial potential of Russia’s most important region while improving the energy security of the country in general, enhancing the quality and safety of its electric power transmission and distribution services in accordance with the global standards, while also continuously and steadily improving and developing the grid complex in the Tyumen Region, the KhMAO-Yugra, and the YNAO.

Systematic efforts in grid renovation and commissioning of new facilities is still a relevant objective and high priority for Rosseti Tyumen JSC.

More than 42 local grid operators operate in the Tyumen Region beside Rosseti Tyumen JSC; these operators provide such services as grid connection within their localities or serve specific industrial enterprises. Such grid operators mostly have no direct access to the UNEG and supply power of low-to-medium voltage (0.4-10 to 10 kV); they are connected to Rosseti Tyumen JSC’s grid as the latter has higher voltage.

Rosseti Tyumen JSC’s Regional Market Share in 2021

- SUENKO PJSC,

- Surgut City Electric Grids LLC, Gorelektroset

- JSC Energo-Gaz-Noyabrsk JSC,

- UTEK-Regional Grids JSC, GDC of Yamal JSC

Where We Stand in Domestic and International Markets

Currently, Rosseti Tyumen JSC competes against:

- FGC UES PJSC

FGC UES PJSC offers its electric power transmission services at a drastically different price, which motivates our customers to switch to FGC UES’s services; as a result, our electric power transmission and revenue figures fall short of plans.

- Local grid operators

Local grid operators currently present in the Tyumen Region, KhMAO–Yugra, and YNAO are involved in grid asset consolidation.

The companies most involved in the power grid assets consolidation are: SUENKO PJSC, YuTEK-Regional Grids JSC, Gorelektroset JSC Nizhnevartovsk, which are part of the STS Corporation LLC holding structure.

Given that the energy service market is growing, and the emergence of competition seems quite possible, Rosseti Tyumen JSC prioritizes the expansion of its grid; expansion efforts include the development and enhancement of the procedures for connecting consumer-side inputs to Rosseti Tyumen JSC’s grids as well as the consolidation of grid assets.

Development Strategy

Strategic Goals

Throughout its history, Rosseti Tyumen JSC has adhered to the core principles and priorities of the industry. Medium- and long-term action plans have been devised to attain the goals. The Company’s strategic priorities are set forth by its shareholder Rosseti PJSC.

In June 2020, the Government of the Russian Federation approved the new Energy Strategy of the Russian Federation until 2035 (Government Decree No. 1523-r dd. June 9, 2020). Russia’s energy policy prioritizes national energy security, meeting the domestic demand for energy and related services, a transition to eco-friendly, resource-saving energy, boosting competition in the fuel and energy industry, using domestically manufactured equipment, making all levels of management more efficient in the fuel and energy industry, and taking advantage of centralized electricity delivery.

Russia’s electric power targets for 2020 are set forth in the Development Strategy of the Electric Power Grid Complex of the Russian Federation as approved by the Decree of the Russian Government No. 511-р dd. April 3, 2013 On the Approval of the Development Strategy of the Electric Power Grid Complex of the Russian Federation.

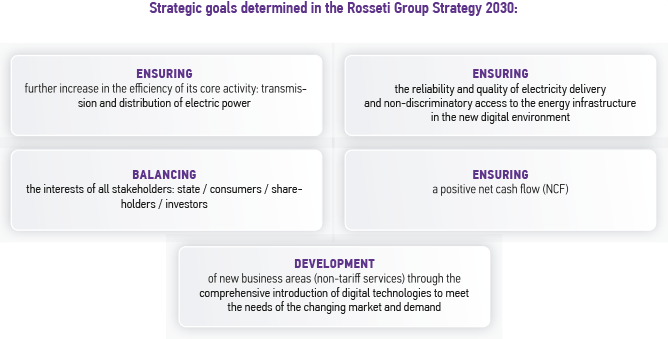

On December 26, 2019, the Board of Directors of Rosseti PJSC approved the Development Strategy of Rosseti PJSC and its SDCs (“Rosseti Group”) (“Rosseti Group Strategy”) for the period until 2030.

Rosseti Tyumen JSC acts within the Rosseti Group Strategy in the long term.

Strategic goals determined in the Rosseti Group Strategy 2030:

The company has determined the core aspects of the strategic development:

- technological and innovative development;

- digital transformation;

- business diversification;

- maintaining a set level of reliability and security of power supply;

- ensuring further increase in operational and investment efficiency;

- increasing the grid service market share;

- HR development.

In order to pursue the Rosseti Group Strategy, Rosseti Tyumen JSC adopted several policy documents including:

- Rosseti Tyumen JSC’s Digital Transformation Program 2020–2030;

- Innovative Development Program of Rosseti Tyumen JSC;

- Smart Metering Development Program 2020–2030;

- Rosseti Tyumen JSC’s Electricity Loss Reduction Program for 2020 and up to 2024;

- Power Grid Complex Environmental Policy;

- Rosseti Tyumen JSC’s Personnel and Social Policy;

- Rosseti Tyumen JSC’s Investment Policy;

- Rosseti Tyumen JSC’s Comprehensive Security Policy, etc.

Strategy Implementation in 2021

The Company implemented and forecasted solutions to the following key objectives across its strategic areas in 2021:

-

In technological and innovative development:

- increasing the efficiency of technological management of grid assets;

- development and adoption of promising innovative and digital technologies.

-

In digital transformation:

- reengineering of technological and business processes of the Company.

-

In business diversification:

- development of services to enter new markets.

-

In maintaining a set level of reliability and security of power supply:

- ensuring accessibility of grid infrastructure at a set level of reliability and quality of power supply;

- ensuring security of information infrastructure facilities;

- import substitution of foreign software products.

-

In ensuring further increase in operational and investment efficiency:

- reduction in losses in grids;

- maintaining a high level of customers’ financial discipline;

- changing internal approaches to drafting the investment programs and project management;

- development of smart metering;

- expansion of the existing grids, optimization of manufacturer, contractor, and customer relations;

- increasing financial and economic efficiency;

- taking part in the working groups of Rosseti PJSC to promote legislative initiatives (pricing of electricity and grid connection, LGO criteria).

-

In increasing the grid service market share:

- consolidation of LGOs and power grid facilities/assets.

-

In HR development:

- recruitment of high-skill specialists.

Plans and Targets

The implementation of the Rosseti Group Strategy in the long term is mainly dependent on:

- keeping a set level of reliability and security of power supply;

- optimizing investment programs depending on the financial results of the Company and the electricity demand;

- increasing the Rosseti Tyumen JSC market flexibility through business diversification by developing and implementing non-tariff services / consumer services, including digital services;

- ensuring a high quality of customer service, increasing NPS, Company’s customer focus;

- systematic implementation of the Program for improving operational efficiency and reducing costs to optimize the Company’s operating expenses while keeping all social obligations to the Company’s employees, the budget and counterparties;

- effective planning and management of cash flows to ensure a high level of the Company’s solvency;

- effective credit portfolio management by maintaining the credit limit at a sufficient level and diversifying it (including existing loans refinancing in order to reduce the borrowing cost and attracting new loans at competitive interest rates);

- effective use of funding sources for the investment program in order to maintain a balance between the actually available financial resources and the objectives of the Company’s development;

- limiting the maximum amount of funding for projects without immediate economic effects (the higher the reliability indicators achieved, the stricter the limits should be);

- setting a higher priority for projects with positive economic effects (NPV>0, IRR>WACC) when decided on inclusion in the investment program.

Based on these principles, the Company has developed an action plan for the period for up to 2030.

Work done in 2021 and the Company’s plans for up to 2030

- under the project “Development of a mobile small-sized drilling rig for mounting and reinforcing composite anchors in the ground, strengthening the HVL tower groundings. Development of composite anchors for strengthening “chopped” reinforced concrete piles of the foundations of supports and screw / pipe pile foundations of HVLs in the permafrost soils of the Arctic and the Far North”;

- under the project “Development of UVK-M vibration excitation device for automated removal of frost and hoar deposits (“kurzhak”) from wires and cables of 110-220 kV HVLs in the Far North and the Arctic”.

- patent research on UVK-M design and operating principle was conducted;

- the analysis of the results of the UVK-M prototype operation in the electric grids of Rosseti Tyumen JSC was performed;

- technical requirements for UVK-M design were developed and approved;

- models of UVK-M were developed and tested;

- draft design of UVK-M was prepared;

- a comparison of the technical and economic indicators of the developed product was made;

- UVK-M models were developed, manufactured and tested.

- “Development of UVK-M vibration excitation device for automated removal of frost and hoar deposits (“kurzhak”) from wires and cables of 110-220 kV HVLs in the Far North and the Arctic”;

- “Development of a mobile small-sized drilling rig for mounting and reinforcing composite anchors in the ground, strengthening the HVL tower groundings. Development of composite anchors for strengthening “chopped” reinforced concrete piles of the foundations of supports and screw / pipe pile foundations of HVLs in the permafrost soils of the Arctic and the Far North”.

- an integrated solution that enables communication and effective coordination of parties involved in the Company’s innovative development, which uses the existing knowledge accumulation, preservation, and dissemination solutions.

-

The following works were completed:

- collection of data on the inspection of HVLs is carried out using UAVs;

- collection of information about accidents is carried out using UAVs.

- a system for monitoring the operational reliability indicators of the electric grid facilities of Rosseti Tyumen JSC using an unmanned aerial system (UAS);

- UAVs deployment to monitor remote grid facilities located in hard-to-reach Arctic regions where transport infrastructure is insufficient;

- condition-based HVL reliability indexing;

- prediction-based action scenarios devised to be included in emergency monitoring routines.

- technical and organizational issues were worked out regarding the phased adoption of SK-11, an implementation plan was prepared and the purchase of licenses was planned for Astra Linux and SK-11.

- creating a single analytical platform capable of event prediction;

- creating a single geoinformation system.

- innovative equipment and technologies were tested and implemented (Rospan 110 kV substation, Batovo 110 kV substation, Chaprovskaya 110 kV substation put into operation;

- automated system “Occupational health and safety (AIS OHS) based on the “Production safety. Integrated security” software

- implementation of projects for adoption of digital substation elements (Bystrinskaya 110 kV SS, Nevskaya 110 kV SS, Fakel 110(220) kV SS, Bolshechernogorskaya 110 kV SS).

- a training program for internal personnel of Rosseti Tyumen JSC was developed.

- construction of the Salekhard-Labytnangi-Kharp power bridge.

- in Onokhinsk municipality; and

- in Chervishevsky municipality.

- the Tyumen Electric Grids branch of Rosseti Tyumen JSC and R.V. Gein IE concluded an agreement worth 34 million rubles for the construction of electric grids at the customer’s facility.

- 49 educational programs of Rosseti Tyumen JSC were developed and approved.

- Corporate Moodle-based learning management system is being introduced.

-

Pursuant to the Order of Rosseti Tyumen JSC No. 247r dd. November 23, 2021 “On distance learning at Rosseti Tyumen JSC”:

- professionals from Noyabrsk, Nizhnevartovsk, Tyumen, Surgut Electric Grids, Energocomplex developed a training material for 10 educational programs of Rosseti Tyumen JSC;

- responsible experts, IT professionals form the Surgut Electric Grids, were appointed for the administration and maintenance of the Moodle learning management system for PTC-based training process;

- the training content from Rosseti Tyumen JSC training programs is being converted into the SCORM format for further transition to Moodle.

- An application has been formed for the procurement of essential hardware for the training process (servers, printers, projectors and laptops) to be included in the Rosseti Tyumen JSC 2022 investment program.

- cooperation and coordination agreement between Rosseti Tyumen JSC and the Yugra Science and Technology Development Foundation (the Project Operator);

- a draft cooperation and coordination agreement with the Federal State Budgetary Educational Institution of Higher Education “Ugra State University” to create an electric power infrastructure was prepared and approved, ensuring the development of the remote area of KhMAO-Yugra;

- the development area in terms of systems based on renewable energy sources (hybrid power-generating plants) was determined.

- an analysis of potential options for connecting to existing grids and building a power center for the SEZ Industrial site was performed;

- preliminary negotiations were held with the Yugra Development Fund;

- Rosseti Tyumen JSC offered to take part in the creation of engineering infrastructure on the planned SEZ territory.

- a cooperation agreement with the Yugra Development Fund was made;

- a cooperation agreement with the Government of the Tyumen Region for ensuring reliable electricity delivery to customers in the Tyumen Region was made.

- a license agreement with manufacturing companies for the production and implementation of the Minigrid was concluded;

- a cooperation agreement to implement the Minigrid HSP at the facilities of potential buyers (Rosneft, Aggreko Eurasia, and Gazpromneft) was concluded;

- a lease agreement to demonstrate the Minigrid HSP functioning to potential buyers with Moscow Power Engineering Institute was concluded.

- upgrading communication channels for the implementation of OTM functions (type “star” network topological scheme);

- upgrading of the backbone data transmission network (development of a ring backbone network);

- development of redundant data transmission channels at the branch level.

- an implementation plan and design specifications were developed.

-

in terms of creating an integrated solution for business processes for customer services and interaction, the program and methods for preliminary testing was approved, integration was tested in the following streams:

- IF1. “Power Center” Integration Flow;

- IF2. "Applications for GC" Integration Flow;

- IF3. “Applications for GC” Integration Flow.

- functionality to manage the process of eliminating emergencies (through tasks and crews) developed;

- automatic synchronization of power grid facilities from the PAMS to the Geoinformation System (GIS) is configured;

- display of heat points for CCU was implemented;

- the functioning of the Company’s single geoinformation system was tested and is adopted in order to monitor the process of security enforcement of the served facilities.

- a services and coordination agreement for monitoring and responding to computer attacks with the FSB of Russia National Coordinating Center for Computer Incidents and FOCL-VL Upravleniye LLC was concluded.

- 6 technological maps were approved in accordance with the development plan for VR and AR simulators.

- the Electronic Document Management System (EDMS) project based on the Russian-made Documino platform was completed as part of the import substitution plan;

- an action plan was approved for the transition of the Company to the predominant use of Russian-made software for 2021–2024.

- 7 vehicles were purchased in 2021 to increase the reliability of the vehicle fleet

- projects for the development of commercial electricity metering (30 points of commercial meters and 5,668 metering devices installed), for the development of technical metering (509 metering devices installed);

- projects for installing metering devices in accordance with the Federal Law No. 522-FZ dd. December 27, 2018 in the amount of 2,941 pcs. worth 181 million rubles.

- An effect of 34.8 million kWh was achieved worth 82.9 million rubles.

- to 2.25% of electricity released to the grid in 0.4-110 kV grids;

- to 9.96% of loss-inducing electricity released to the grid in 0.4-20 kV grids;

- ranking and prioritization of activities in accordance with the scenarios approved by Rosseti PJSC;

- achieving maximum efficiency while ensuring the required level of reliability;

- excluding unnecessary technical solutions;

- update the deadlines under connection agreements in light of the loading plans and the deadlines for applicants’ facilities.

- the procedure for determining the capacity reserve of power centers was updated, providing for an increased efficiency of power centers utilization.

- technical requirements and a list of procured goods for the core electrical equipment were prepared;

- a draft supply agreement was prepared to support procurement procedures in 2022 for concluding long-term supply agreements at unit prices.

- cooperation with the Government of KhMAO-Yugra;

- service companies planned to be sold in a single lot with YuRESK JSC were reorganized.

- purchase of grid assets amounting to 444.7 c.u. in the Tyumen region and YaNAO (an increase in the market share by 0.02%).

- a list of mandatory training according to position at Rosseti Tyumen JSC was developed;

- the Company’s training system was assessed and the level of satisfaction with the quality of training in the Company was determined;

- the Company’s Regulations on the training activities were developed.

- more than 50 educational activities were carried out aimed at developing the professional and corporate competencies of managers and professionals in the development and services area.

Contribution to the UN Sustainable Development Goals

Priorities in the field of sustainable development

Ensuring the reliability and quality of power supply

Value – WE ENSURE reliable and high-quality power supply.

Value – WE PROVIDE affordable grid connection services.

Activities performed in 2021:

- reconstruction and construction projects were implemented for substations and power grids in various regions of the country;

- maintenance and repair programs were implemented;

- planned volumes of the Program for the updating of grid facilities were met by all subsidiaries and affiliates;

- response to every risk-bearing situation was ensured;

- ensuring accessibility of grid infrastructure at a set level of reliability and quality of power supply;

- ensuring security of information infrastructure facilities;

- import substitution of foreign software products.

Results in 2021:

- Uniform down-top tariff rates for H1 2021 do not exceed the rates for H2 2020; 10.3% higher rates were approved for H2 2021;

- in the reporting period, the grid connection fee rate per unit of connected capacity for the “last mile” activities under completed contracts amounted to 15,426 rubles / kW, with 9,816 rubles / kW in 2020, and 7,569 rubles / kW in 2019;

- the total volume of the maintenance and repair program implementation amounted to more than 4 billion rubles; 224 power transformers and transformer substations (CTSS, PTSS, DTSS), 2,566.4 km of power transmission lines with 0.4+ kV voltage were repaired, 58.4 km of ground wire were replaced;

- facilities for electricity delivery to oil and gas fields located in KhMAO-Yugra and YNAO were put into operation. Some of them were built by the Company at a record-breaking pace. The total investment of power engineering companies in the economy of the regions amounted to about 8.5 billion rubles.

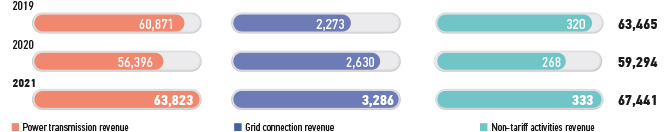

Revenue structure, million rubles

KPIs:

- effectiveness of innovation;

- compliance with the commissioning schedule;

- winter preparedness;

- no accidents at work.

Ensuring resilience to changes in the electricity market

Value – WE DEVELOP new services.

Activities performed in 2021:

- reengineering of business processes for the development of additional services;

- participation in lighting projects for cities/towns;

- development of the turnkey grid connection service;

- development of a corporate training center;

- the Company’s Program for the Development of the Electric Charging Infrastructure up to 2025 was developed;

- involvement in the implementation of the project to create the first special economic zone (SEZ) in KhMAO-Yugra;

- a license agreement with manufacturing companies for the production and implementation of the Minigrid was signed;

Results in 2021:

- the increase in revenue from additional (non-tariff) services of the Company in 2021 compared to 2020 amounted to 24.4% or 353.420 million rubles

- net profit – 93.47 million rubles;

- profitability of additional (non-tariff) services: 10.05%;

- 5 contracts for lightning cities / settlements for the amount of 9.3 million rubles inclusive of VAT were concluded;

- the Tyumen Electric Grids branch of Rosseti Tyumen JSC and R.V. Gein IE concluded an agreement worth 34 million rubles for the construction of electric grids at the customer’s facility.

KPIs:

- Total shareholder return;

- Labor productivity improvement.

Improving energy efficiency, protecting the environment, and combating climate change

Value - WE PROTECT ecosystems

Activities performed in 2021:

- implementation of the environmental policy for the electric grid complex;

- conservation of biodiversity, including the implementation of measures to prevent the decline in the number of birds;

- continuous improvement of the environmental management system in order to improve the environmental performance;

- reducing the consumption of fuel and energy resources for production and economic needs.

Results in 2021:

- the volume of pollutant emissions into the atmospheric air generated by the Company was generally at the level of 2020 (28.476 tons) and amounted to 28.594 tons, 27.626 tons in 2019;

- the volume of groundwater produced in 2021 amounted to 20.45 thousand m3, which is 15% less than the 2020 value (24.15 thousand m3) and 25% less than the 2019 value (27.3 thousand m3).

- waste generation trends: 2019 – 4,999 tons; 2020 – 4,434 tons, 2021 – 3,050 tons;

- waste transferred for recycling and neutralization: 1,514 tons – 2020 – 3,159 tons, 2019 – 2,926 tons;

- environmental protection costs: 2019 – 46,328 thousand rubles, 2020 – 44,510 thousand rubles, 2021 – 43,210 thousand rubles;

- environmental impact fee: 2019 – 540.59 thousand rubles, 2020 – 298.21 thousand rubles, 2021 – 322.07 thousand rubles;

- equipping power grid facilities with bird protection devices (BPD), pieces: 2021 – 3,740, 2020 – 5,765, 2019 – 5,680;

- equipment with smart metering devices: 70.58% of the total volume, equipment with LED lamps: 85.08% of the total volume;

- the cost of implementing the Energy Saving and Energy Efficiency Improvement Program in 2021 – 248.52 million rubles, VAT exclusive.

KPIs:

- electricity loss rate.

Increasing investment appeal, reinforcing the brand image, improving stakeholder engagement

Value – WE INVEST in the regional economy.

Activities performed in 2021:

- reengineering of technological and business processes of the Company;

- development of services to enter new markets;

- reliable, uninterrupted and high-quality operation of the power system;

- high-quality service, transparency and availability of information;

- meeting the needs in the Company’s services;

- meeting the demand for electricity and capacity;

- paying taxes;

- creating new jobs.

Results in 2021:

- the validity of the certificate of the Company’s energy management system that meets the requirements of the International Standard ISO 50001:2018 has been extended;

- taxes paid, including to:

- KhMAO-Yugra – 2,087,264,343.86 rubles;

- YaNAO – 1,051,637,250.83 rubles;

- the Tyumen region – 735,707,189.70 rubles;

- 100% of competitive procurements were made using e-commerce tools (electronic trading platforms);

- annual volume of procurement from SMEs: 87.98% of the total procurement in 2021, including 28.26% of procurements under contracts limited to SMEs only;

- 359 press releases on the Company’s production activities were published on the Company’s corporate website www.te.ru , 363 posts were made on the Company’s social media accounts, with 185 posts on the Telegram channel; the Company had 10.4 thousand mentions in mass media.

KPI:

- Return on invested capital;

- electricity loss rate;

- timely grid connection.

Development of scientific and innovative potential of the Company and industry, comprehensive introduction of new digital technologies

Value – WE CREATE digital power grids.

Activities performed in 2021:

- increasing the efficiency of technological management of grid assets;

- developing and adopting promising innovative and digital technologies;

- reengineering of technological and business processes of the Company.

Results in 2021:

- an integral performance indicator of the innovative activity assesses compliance of three composite indicators: R&D costs, procurement of innovative products, quality of development (updating) of Front End Engineering Design (FEED) activity / implementation of FEED activity

- two intellectual property documents secured:

- invention patent No. 2744035 Device for detecting a damaged section of an OL with branches of 6-35 kV distribution grids dd. March 02, 2021;

- certificate of state registration of the database No. 2021620637 dd. April 05, 2021 Database containing data representing the required frequency of OL route clearing from tree and shrubbery vegetation in the Tyumen region, the Khanty-Mansi Autonomous Okrug – Yugra, the Yamalo-Nenets Autonomous Okrug;

- adoption of innovations: 326.88 million rubles, 2020 – 527.49 million rubles, 2019 – 458.55 million rubles;

- R&D completion: 21.77 million rubles exclusive of VAT, 2020 – 28.84 million rubles, 2019 – 30.54 million rubles.

KPIs:

- Reduction in per-unit operating costs;

- Labor productivity improvement;

- Effectiveness of innovation.

HR and corporate culture development and compliance with industrial safety standards

Value - WE OFFER HR development.

Activities performed in 2021:

- Implementation of the first stage of the project for creating the VR and AR-based comprehensive staff training system;

- implementation of a distance learning Moodle-based system;

- creating an integrated solution for business processes for customer services and interaction with SDCs as part of the development of a Unified Integrated Platform for Rosseti Group customer interaction, Rosseti Tyumen JSC segment.

- launching the configuration of a digital platform to simplify supplier and contractor interactions involving the document automation subsystem integrated with the Company’s ERP systems and document automations.

- improvement of the organizational and functional structure;

- optimizing work schedule and increasing the workload of the staff;

- automation of business processes.

Results in 2021:

- the Company’s production staffing rate amounts to 97%;

- active turnover in 2021 amounts to 6%;

- 7,138 employees were trained in important areas of training, amounting to 96%;

- 6,398 employees were vaccinated, amounting to 85.3% of the headcount;

- average collective immunity in the Company amounted to 80%;

- 5,638 COVID-19 tests were made during the year;

- on average, 17% of the headcount worked remotely;

- the average salary increased by 3.2% or 109.9 thousand rubles per month compared to 2020;

- OHS costs amounted to 295,478.598 thousand rubles, in 2020 – 292,962.662 thousand rubles, in 2019 – 279,931.815 thousand rubles;

- fires – 3, in 2020 – 4, in 2019 – 1;

- zero cases of work-related diseases.

KPIs:

- improvement of labor productivity up to 5.00%;

- launching of a distance learning system;

- injury prevention activities, improved occupational health and safety level

Key performance indicators, including: KPI system, changes in the KPI system in the reporting year, KPI target values and data on their achievement

Achievement of the priority development goals of the Company is assessed against key performance indicators (KPI) used in the Company.

The key performance indicator system of the Director General of the Company was established under:

- subparagraph 16 of paragraph 12.1 of Article 12 of the Charter of Rosseti Tyumen JSC,

- resolution of the Company’s Board of Directors of October 30, 2020 (Minutes No. 29/20 dd. November 2, 2020).

KPI targets were set by the Resolution of the Board of Directors dd. December 28, 2020 (Minutes No. 34/20 dd. December 28, 2020).

Pursuant to the above Resolutions of the Board of Directors of the Company in 2021, the following KPIs were established:

KPI Targets and Attained Values

attained

95% (Q1 100%, Q2 100%, Q3 101%, Q4 95%) // attained

(in each quarter)

97% (Q1 100%, Q2 100%, Q3 97%, Q4 95%) // 100%

((in each quarter))

1) 0,99;

2) non-attainment of the set value of the specialized indicator // attained

⦁ ≥ 0,95;

2) Non-attainment of the set value of the specialized indicator “Unfulfilled measures for the winter preparedness condition set for the subject of the electric power industry”

1) 1,0

2) non-attainment of the set value of the specialized indicator// 100%

⦁ ≥ 0,95;

2) Non-attainment of the set value of the specialized indicator “Unfulfilled measures for the winter preparedness condition set for the subject of the electric power industry”

1) Psaidi =0,46;

Psaifi =0,70;

2) No significant decline in the indicators set forth by the tariff regulators;

3) 1 = 1 (Zero increase in the rate of major accidents) // attained

⦁ Ki ≤ 1;

⦁ No significant decline in the indicators set forth by the tariff regulators;

3) Zero increase in the rate of major accidents

1) Psaidi =0,97;

Psaifi =1,00;

2) No significant decline in the indicators set forth by the tariff regulators

3) Zero increase in the rate of major accidents

// 100%

1) Ki ≤ 1;

⦁ No significant decline in the indicators set forth by the tariff regulators;

3) Zero increase in the rate of major accidents

⦁ injured person;

⦁ 0 // attained

⦁ Two injured persons at max.;

⦁ 0

1) 1 injured person;

2) 0// 100%

⦁ Two injured persons at max.;

⦁ 0

The Company’s KPI system affects the variable remuneration for the managers; each KPI has a weight that is used to calculate the payable bonuses, which are subject to the attainment of the KPI targets.

Key Risks

Rosseti Tyumen JSC has approved a Functional Risks Register (“the FR”) in order to evaluate the impact of risks on the Company’s KPIs; the significance of these risks is to be revaluated on an annual basis.

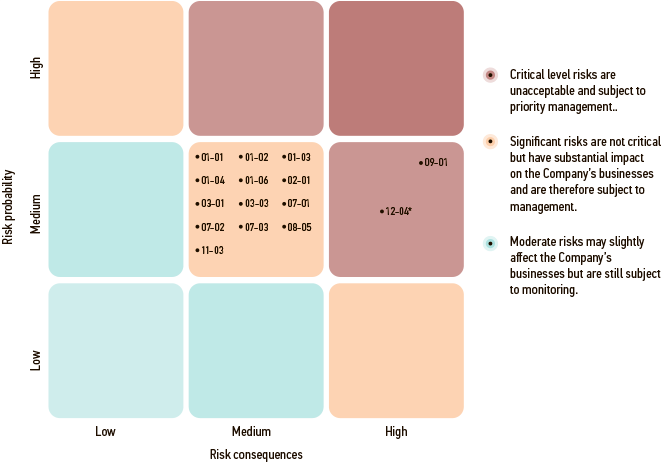

Risks are expert-assessed. Risk assessment assigns the class of significance according to the trilevel classification presented in the Risk Management Regulations: moderate, significant, critical.

Critical level risks are unacceptable and subject to priority management.

Significant risks are not critical but have substantial impact on the Company’s businesses and are therefore subject to management.

Moderate risks may slightly affect the Company’s businesses but are still subject to monitoring.

Map of Rosseti Tyumen JSC’s key risks in 2021

* Risk FR 12-04 “Involvement of the Company / employees of the Company in corrupt practices” is assessed “critical” due to the unacceptability of corruption in any form or manifestation in the Company (“zero corruption tolerance” principle) and the need to take priority measures to manage this risk, while the level of risk probability is assessed as low.

* Risk FR 12-04 “Involvement of the Company / employees of the Company in corrupt practices” is assessed “critical” due to the unacceptability of corruption in any form or manifestation in the Company (“zero corruption tolerance” principle) and the need to take priority measures to manage this risk, while the level of risk probability is assessed as low.

The Company’s activity is associated with the following risks

FR 01-01

FR 01-01

A drop in electric power transmission to customers connected to regional distribution grids

2. Establishing judicial practices to resolve disputes on the quantification of electric power transmission and/or losses.

3. Periodic audits of local subdivisions with respect to the sales of services and the reduction in electricity losses.

4. Monitoring electricity losses and prices

FR 01-02

FR 01-02

Structural change in the rendered electric power transmission services with respect to voltages, tariffs, and customer groups

2. Monitoring the consumption data that last-resort suppliers (electricity providers) use to calculate the electric power transmission fees.

FR 01-03

FR 01-03

Increase in the price of electricity purchased to compensate for losses

2. Wide-scale adoption of smart metering, automated meter readings collection and processing systems to draw balance sheets of electricity, capacity, and electric power transmission quantifications

FR 01-04

FR 01-04

Increase in electric power transmission charges of third-party grid operators

FR 01-06

FR 01-06

TRR fines for non-completion of the Investment Program

Phased monitoring of the construction schedule to ensure the timely development of investment program facilities

FR 02-01

FR 02-01

Investment Program funding increased in general and/or on specific items against the specified limits

2. Monitoring the cost and timing of investment projects.

3. Annual monitoring of per-unit costs of investment projects as part of benchmarking and comparative analysis of per-unit construction costs per unit of physical parameters.

4. Non-excess of the approved Investment Program funding

FR 03-01

FR 03-01

Contractors’ failure to pay for electric power transmission in time and/or in full

2. Monitoring the enforcement of debt restructuring agreements

FR 03-03

FR 03-03

Disputes on the quantification and pricing of rendered services, including disputes on identified unmetered consumption cases

2. Adherence to the Schedule of Handling Electric Power Transmission Arrears and Dispute Resolution; monitoring the collection of electricity fees for consistency with planned figures.

3. Raiding to detect unmetered electricity consumption. Such raids could be scheduled for weekends and involve law enforcement agents; there could also be ‘cross raids’ jointly taken by local subdivisions.

4. Partial and/or complete disconnection of customers-obligors as requested by electricity providers; monitoring the defaulting customers’ compliance with restrictions

FR 07-01

FR 07-01

Untimely engineering, delivery, construction, and commissioning of facilities on part of contractors

2. Filing claims against contractors that default on their agreement terms and conditions.

3. Use of counterparty liabilities’ enforcement tools.

FR 07-02

FR 07-02

Impossibility of obtaining construction permits in time

FR 07-03

FR 07-03

Failure to report disconnection, or a delayed connection of a facility except when caused by the repair of other facilities of the Company

2. Timely completion of activities planned under the Priority Investment Project Schedule (the Extended Grid Schedule) as set forth in Section 6.1 of Datasheets of the projects

FR-08-05

FR-08-05

Operating personnel errors during switching

2. Implementation of the Rosseti Tyumen JSC’s Program (schedule) for equipping the branches of the Company with training simulators for performing operational switching and to develop the skills of operational and repair personnel.

FR 09-01

FR 09-01

Occupational risks

2. CCTV recording of works at power plants in accordance with the developed and approved CCTV Implementation Program.

3. The Company’s Occupational Safety Committee should audit the compliance with the effective Occupational Health and Safety Management System (OHSMS) and the Internal Technical Control System (ITCS) in order to apply appropriate sanctions against officers failing to comply.

4. Completion of the Comprehensive Staff Injury Risk Reduction Program (with a focus on the safety of power plant operations). Better system for safer scheduled maintenance and emergency work at power plants.

FR 11-03

FR 11-03

Works inconsistent with the design documentation or estimates; low quality of equipment and materials, etc.

2. Construction procurements to be performed only after approving the design documentation

FR 12-04

FR 12-04

Involvement of the Company / employees of the Company in corrupt practices

Khanty-Mansiysk

Autonomous Okrug

- Yugra, Surgut

8 800 220 0 220

8 800 200 55 03

www.te.ru